13+Years, More than 25,000 Clients and 5000+

agreements drafted

Overview

It is very important to make a robust, secure, and water-tight partnership agreement. Prior to the commencement of a business together by partner(s), it is imperative that they ensure that all the partners agree and are on the same page pertaining to the objectives of the firm. The partnership agreement makes a mention about the partner’s proportion of the ownership of the firm, and consequently their share in the profits, and liabilities. It also makes a mention of their rights, responsibilities, and duties. Further, the duration of partnership and conditions for the termination of the partnership are also some important details that are included in the partnership agreement. A partnership can also be a less formal operative structure than incorporation which would be able to inter a lip protects owners within the event of the death of one partner, a dispute, purchase to a replacement partner or the dissolution of the business. Our team at IPLF is well versed with all factual and legal scenarios that are mainly required to interact in drafting a sound Partnership Agreement.

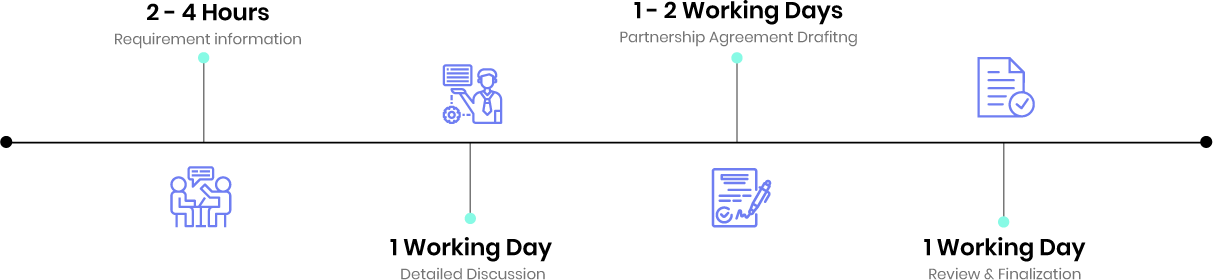

What Is The Process?

1. Understanding requirements

The process of drafting a partnership agreement is initiated with the understanding of the requirements of both/all the partners, and the purpose for which the partnership is being proposed.

2. Discussion

After this, a detailed discussion usually takes place between the partners. As a consequence of this discussion, the partners finalize the terms of their partnership deed.

3. Drafting and finalizing

Pursuant to the detailed discussions between the parties, a partnership deed is drafted by a professional. Thereafter, the partners usually review it and after the detailed review by the partners, the agreement is finalized.

Details Required

- Name and address of the firm

- Name and address of the partners

- Nature of business that is to be carried on

- Date of commencement of the business

- Duration of partnership as decided between the parties

- Capital contribution by each partner

- Profit-sharing ratio as decided amongst the partners

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. Should a partnership deed be registered?

Even though it is not compulsory to register a partnership firm as per the Partnership Act 1932. However, registration is definite proof of the existence of the firm and its legality. From a legal standpoint, the registration of a partnership firm will not alter the fact that the firm does not have a separate legal identity.

2. How do partnerships terminate?

In the absence of a written agreement, the partnership can be terminated if one partner gives the notice of his express will to leave the partnership. Therefore, if you desire stability and continuity in the partnership, it becomes essential to have a written agreement that clearly lays out the process for dissolving the partnership firm.

3. What is the difference between a partnership and forming a corporation?

One major difference between a partnership and a corporation is that the creditors can sue you personally to repay business debts. Whereas, if there is a formation of a corporate entity, such as a limited liability company (LLC) or an S-corporation, the debt trail is limited to the business.

4. Is it mandatory that the partnership agreement be in writing?

It is always good to have a written agreement but it is not compulsory to have a written Partnership agreement.

5. What are the advantages of forming a partnership?

Advantages of a partnership firm are:

- The establishment is easy,

- If there are a large number of owners, it eases the process of raising funds.

- Tax reporting becomes very simple and expeditious since the profits go directly into the partner’s pockets.

- Partners can combine their individual talents to complement each other and strengthen the partnership.

- Employees may be attracted to work for the partnership if they have a chance to become a partner.

6. What are the disadvantages of forming a partnership?

Disadvantages of a partnership firm are:

- For business debt, partners are jointly as well as individually liable.

- Partners are constrained and liable for the actions of other partners.

- The partnership can be easily terminated, by the mere leaving of one partner.

- Not having full control means having shared decision making, which could lead to disagreements or paralysis of the partnership.