17+ Years, More than 20,000 clients and 10,000+

registrations done

Overview

According to the Indian Companies Act, 2013 or the previous Companies Act, a Private Limited Company is defined as a privately held entity, which is registered under the Act. The usage of the term “Limited” is clearly suggestive of the fact that the liability of the members of the company i.e. owner and other members is limited to a certain extent. Moreover, there are certain restrictions in this form of a company, along with some privileges offered.

Shareholders: The minimum number of shareholders that are required to initiate a Private Limited Company is two while the maximum number of the shareholders can not exceed two hundred, in consonance with the Companies Act, 2013.

The number of directors: A Private Limited Company needs a minimum of two directors. Out of those two directors, it is necessary that at least one director has stayed in India for a total period more than or equal to 182 days in the previous calendar year. It is also possible that the directors and the shareholders are the same people.

Capital: The minimum amount of share capital required to start a private limited company is Rs. 1, 00,000 (One Lakh)only.

Limited Liability: As indicated by the usage of the word “Limited”, the liability of each shareholder or member is limited. This implies that if the company, by chance runs into a loss, the company shareholders would be liable to sell their company shares to the tune of the amount required to clear the debt or liability. This further implies that the individual or personal assets of shareholders or members are not at risk.

Perpetual succession: As per the Companies Act, 2013, perpetual succession refers to the situation in which the company continues to exist even when an owner or any member dies, goes bankrupt, exits from the business, and/or transfers his shares to another person.

Prospectus: A prospectus is a detailed statement that is issued by a company that desires to go public. However, there are no obligations on Private Limited Companies to issue a prospectus because the public at large is not invited to subscribe for the shares of the company.

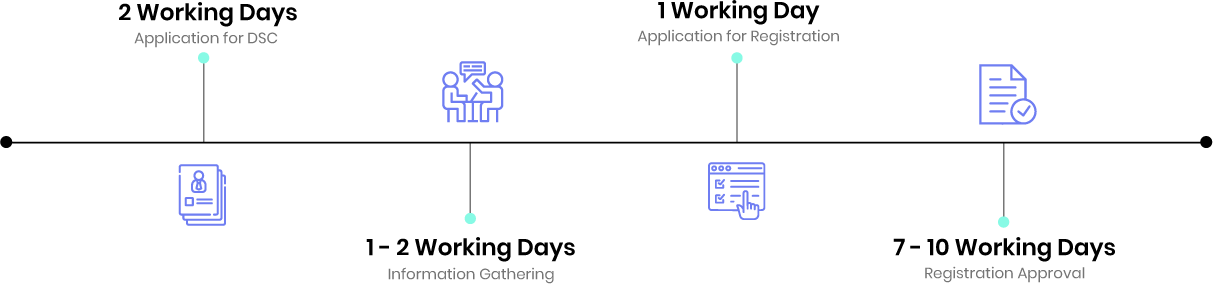

What Is The Process?

- 1. Prior to the process of registration, our team conducts a name check on the availability of the proposed company name and then select up to two names in order of preference and file Form SPICe + Part A for Name Reservation Application.

- 2. Once the proposed name is approved or is available, we then apply for company registration within 20 days of the name approval.

- 3. It is advisable to obtain a Digital Signature Certificate (DSC) if it’s not available with the party. It is an essential requirement during the form submission.

- 4. The next process involves drafting a suitable Memorandum of Association (MOA) and Articles of Association (AOA), which are duly stamped with payment of stamp duty and signed by at least two subscribers, witnessed by at least one person.

- 5. Thereafter, Form SPICe + Part B should be filed for the formation of Company including DIN Application, Registered Address, Share Capital, First Directors, and Subscriber to the MoA and AoA etc.

- 6. Pursuant to this, the Company is registered within 10 – 15 business days and a Certificate of Incorporation and Corporate Identification Number (CIN), Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), ESI and EPFO registration is issued by the appropriate authority.

Details Required

- A short description of the company and the business.

- Name of the city where the registered office of the company is located.

- Ownership and sale deed (In case it’s your own premise).

- Identity proof of the Directors and Shareholders (PAN Card).

- Address proof of the registered office (Electricity Bill, Telephone Bill, etc.).

- Address proof of the Director or the Shareholder (Voter ID, Passport, Driving license, etc.).

- Occupation details of directors as well as shareholders.

- The email address of the directors and shareholders.

- Contact details of directors and shareholders.

- Passport size photo of directors and shareholders.

- In case the property is on rent then you need to submit a copy of the rental agreement with a No Objection Certificate (NOC) from the landlord.

- In the case of foreign nationals, Passport is mandatory, while any other government-issued.

- ID (residence or citizenship card or driving license) and a bank statement or any utility bill in the name of the person will be required as address and residential proof.

- Translation will be required in case if the documents are not in English.

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What is a DSC?

DSC stands for Digital Signature Certificate. Its use majorly pertains to the signing of electronic documents. For the purposes of the registration of a Private Limited Company, either majority or all documents needed are electronic; therefore, it is imperative that all the partners have a DSC.

2. What are the qualifications required to become a director or shareholder in a Private Limited Company?

There are no specific qualifications or impediments against becoming a director or shareholder in a Private Limited Company. Pertinently, any natural person can become a director or shareholder of the company.

3. Can one register a Private Limited Company on their home address?

Yes, one can register the company at their residential address. The only requirement is to submit a copy of the utility bill of the same.

4. What is a Director Identification number?

A Director Identification Number or DIN is an 8-digit unique identification number. This is allotted by the Central Government to each individual who wishes to become a director of any company or who has already become a director of any company. Once allotted, the DIN number has lifetime validity.

5. Once a company has been registered, is it possible to change its registered office?

Yes, a company can change its registered office by filing an appropriate form with the Registrar of Companies.

6. Can a Private Limited Company make Foreign Direct Investments in India?

Yes.

7. What is meant by Limited Liability protection?

Limited Liability is a form of legal protection for the shareholders, and owners that protects individuals from being held personally responsible for their Company debts or financial losses. By the action of separating the finances of the owners and the business, the business becomes responsible for its own liabilities, debts, and financial losses. This distinction creates legal protection for owners and shareholders, who would be under no legal obligation to pay any debts or cover any losses if the business were to fail.

8. Is the trademark automatically protected on the registration of the company?

No, trademark registration is a completely different process from company registration. The mere act of incorporating a Private Limited Company doesn’t provide trademark protection. In order to obtain trademark protection, it is essential to get it registered differently in order to protect it.

9. Who is the Registrar of Companies (ROC)?

ROC is a Government Office, to whom the responsibility of the registration of the companies is entrusted. Every State has one ROC office except Maharashtra and Tamil Nadu where there are two ROC offices. In Maharashtra, companies can be registered with Mumbai and Pune ROC. In Tamil Nadu, companies can be incorporated at either the Chennai and/or the Coimbatore ROCs. In all other States like Delhi, there is only one ROC office.

10. Is Private Limited Incorporation to be renewed every year?

No. Once the company is formed, it will be valid until it is officially closed down by the owners. No renewal or fees is required. However, every year companies have to file very basic returns with the ROC office.

11. Does PF, GST is automatically applicable to Private Limited?

There is no automatic applicability. Provident Fund (PF), GST applicability is the same for all types of businesses like a sole proprietorship, partnership firms, and companies. These laws are applicable only after crossing certain threshold limits.

12. Is it mandatory to have some level of turnover to start Private Limited Company?

No, a Private Limited Company is one of the modes of doing business, which means it can be started from scratch. For that matter, even after incorporating a private limited, there is no obligation that the company must have sales or turnover.

13. What is the capital of the Company?

Capital in general terms means investment made by shareholders into the company. Authorized capital is an amount up to which the company can issue shares. This capital is clearly mentioned during the incorporation of the company. On the basis of the set capital, the ROC registration fees and stamp duty is paid. Paid-up capital is an actual investment that goes from shareholders into a company bank account, against which a share certificate is issued by the company.

14. Where is the share capital deposited at the time of Incorporation?

After the company is registered, it needs to open a company bank account, and then anytime within two months of incorporation, capital can be deposited into the company bank account.

15. What are MOA and AOA?

Memorandum of Association (MOA) is a document that contains essential information for the incorporation of the company. Articles of Association (AOA) on the other hand, is a document that contains all the rules and regulations that govern the company.

16. In what circumstances are physical copies of MOA and AOA required to be signed and attached?

Physical copies of the MOA and AOA are needed to be signed and attached in the case where there are non-individual first subscribers, who are based out of India, or individual foreign subscribers do not hold a business visa. It is to be noted that if physical MOA and AOA are filed, then there is no need to attach eMOA and eAOA.