17+ Years, More than 25000 clients and 5,000+ filings

Overview

Tax Deduction at Source (TDS) as the name suggests, is basically a tax that is paid to the Government right when a transaction takes place, either when the payment is made or when the amount gets credited. As a part of tax compliance, any person/organization that is liable to deduct tax at source on certain transactions like salary, payment to professionals, payment of rents (exceeding a particular amount), life insurance policies, among others has to file a TDS return quarterly with the Income Tax Department. Each such transaction has a prescribed rate of interest that is kept in mind while filing a return with the Income Tax Department. While filing ITR (Income Tax Return), the person can claim the benefit of the amount of tax that has been deducted only if the TDS return is filed on time.

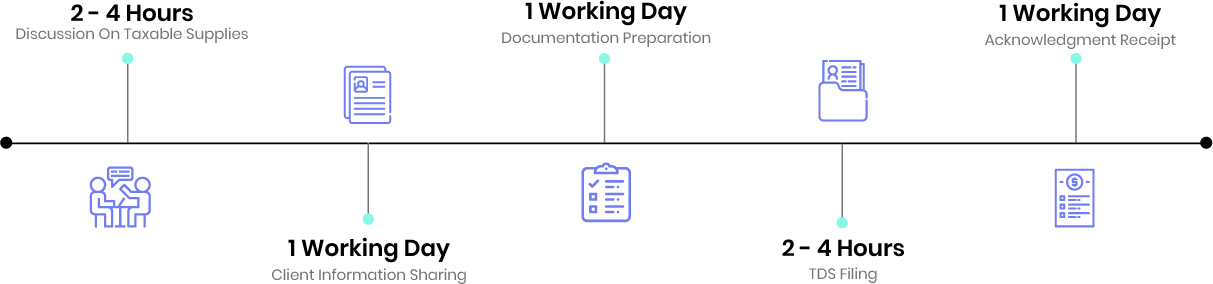

What Is The Process?

1. Assessment

The first step is a discussion of the client with our team regarding the information on taxable supplies. Our team would then procure all necessary details and information from the client.

2. Preparation

Preparation of documents that are to be filed for the TDS return by our team.

3. Finalization

Our team then discusses the final draft of the application with the client and moves ahead with the filing online upon receipt of approval from the client. An acknowledgment receipt is shared with the client and a copy is kept with our team.

Details Required

- Tax Account Number (TAN)

- Tax Receipts

- Details of the deductions

- Incoming & Outgoing Taxable Supplies Invoice

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. Is there a penalty for non-filing or delay in filing of TDS?

In case of missing the due date of TDS filing, the taxpayer has to pay INR 200 for per day of delay. Moreover, the taxpayer might also have to pay a minimum penalty of INR 10,000 extending to INR 1,00,000 as per section 271H of the Income Tax Act for failure to furnish statements of TDS filing within the due date.

2. What is a TDS Certificate?

TDS Certificate (Form 16/16A) is a mandatory certificate issued to taxpayers on deduction of tax by the employer on behalf of the employees, which provides the relevant details of TDS of transactions between deductor and deductee.

3. When is normally the TDS deposited?

Every taxpayer has to make the payment of TDS before the 7th day of each month.

4. What is the Tax Information Network (TIN)?

TIN is an initiative by the Income Tax Department of India (ITD) for the modernization of the current system for collection, processing, monitoring, and accounting of direct taxes using information technology.

5. What are the benefits of TDS?

Regular collection of taxes ensures a flow of regular income to the government. It helps in the reduction of the burden of taxpayers on paying a lump-sum tax amount. Offers an easy mode of tax payment to the payer.

6. What is a TDS Refund?

TDS Refund is the amount that is given back to the taxpayer, at the end of the year, if the tax deducted at source is more than the actual tax liability of the taxpayer.

7. What is the time period of TDS Refund?

Time period of TDS refund depends on timely payment of IT Returns. If there is no delay i.e. the IT Return is filed within the due date, the taxpayer gets the refund within 3-5 months.