17+ Years, More than 25000 clients, and 3,000+ filings done

Overview

Since 2017, a major portion of the indirect tax system in India is governed by the Goods and Service Tax Law. A return is basically a document involving details of income that a taxpayer is required to file with the tax administrative authorities, for them to calculate tax liability. As per the Goods and Service Tax (GST) Act, any person/business who is registered under GST shall have to make a GST Return Filing for calculating tax liability and that should include purchases and sales invoices raised by them. Businesses registered under GST shall make sure that two monthly and one annual return are mandatorily filed, through the respective GSTR forms, amounting to 26 returns filed in a year.

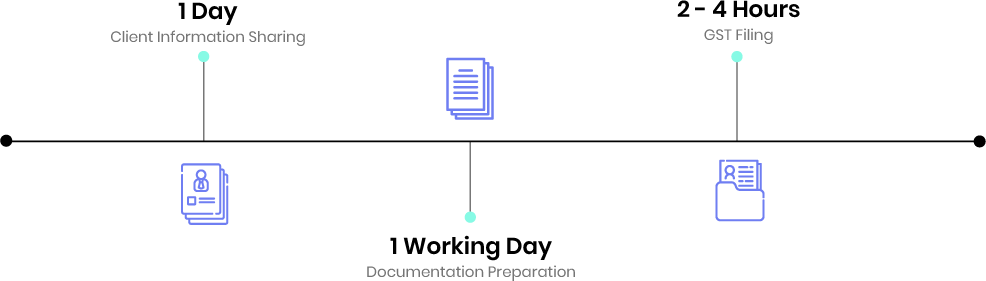

What Is The Process?

1. Information gathering

The first step is sharing information on the purchases and sales by the client with our team. Our team shall then prepare documentation after the relevant documents, invoices, and login information are provided by the client.

2. Return filing

GST Return Filing is then done online in the concerned GSTR form with the signature of the client. The acknowledgment of filing is then received and intimation of the same is provided to the client over email.

Details Required

- GSTIN (GST Identification Number)

- GST Registration certificate

- Log-in information

- Digital Signature

- Details of the business

- Relevant sales and purchase invoices

- Other necessary documents

Timeline

Filing of GST Returns takes around 2-4 hours after all the relevant documents are provided for.

Testimonials

Get Started

Frequently Asked Questions

1. What are the taxable items under the GST Act?

All transactions of taxable goods and services with respect to sale, transfer, barter, exchange, a license that is made for consideration falls under the purview of taxable items under GST.

2. Is it mandatory to file both monthly and annual return?

Yes, all taxpayers registered under GST are required to file both monthly and annual returns.

3. What are the special category states under GST?

Jammu & Kashmir, Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand are special category states.

4. What is the threshold limit of annual turnover for GST Registration for normal category states?

In case of sale of goods, the annual turnover for GST Registration for normal category states is INR 40 lakhs. In the case of service providers, the annual turnover for GST Registration for normal category states is INR 20 lakhs.

5. What is the threshold limit of annual turnover for GST Registration for special category states?

In case of sale of goods, the annual turnover for GST Registration for special category states is INR 20 lakhs. In the case of service providers, the annual turnover for GST Registration for normal category states is INR 10 lakhs.

6. Are there different forms for filing of CGST, SGST and IGST?

No, the same GST Return form is used for filing of CGST, SGST and IGST, as it has different specified columns for all three.

7. What are the consequences of late filing of GST?

In such a case, the taxpayer has to pay INR 100 per day as late application fee which may extend up to INR 5,000

8. Is it possible to amend the documents after the filing has been done?

No, it is not possible to amend the documents after filing. However, in case an amendment of document is necessary then the tax authority shall be intimated to reject the previous filing documents.