17+Years, More than 25,000 Clients and 500+ cases

Overview

Owing to a rise in commercial transactions, there has been a substantial increase in commercial disputes over the past two decades. It is not unusual for individuals, including companies, businesses, and owners, to face litigation problems despite good intentions. Proper guidance from a professional attorney will definitely help to bring the matter to a logical conclusion in a cost-effective way, which is the very aim that IPLF aims to accomplish, taking into consideration that proceedings can be long and expensive.

Contract / Agreement Drafting, Vetting, and other Litigation Support services are offered by our specialized team of lawyers across 13 offices in India, providing our clients with well-strategized legal opinions at all stages of Commercial Litigation to help resolve such litigation through various other means and procedures such as Mediation, Conciliation, Neutral Evaluation, Pre-Arbitral Referee, Mini-trial or even re-negotiation of contracts, before the same end up before a court of law. Our team of experts has rich experience and skill in matters pertaining to the Companies Act and the Insolvency & Bankruptcy Code (IBC) before the National Company Law Tribunal (NCLT) and the National Company Law Appellate Tribunal (NCLAT) including other aspects of Business and Corporate Laws in India and the incorporation of Companies, Corporate Restructuring, Oppression/Mismanagement, Winding Up inter alia.

Our Services Include:

In a diverse range of litigation cases, we offer legal advice and represent our clients, such as:

- Breach of Contract

- Partnership Disputes

- Shareholder Disputes

- Director Disputes

- Private Deals

- Regulatory Investigations and Litigation

- Privacy & Cyber-security

- Fraud

- Injunctions

- Debt Recovery

- Insurance Disputes

- Bankruptcy Adversary Proceedings

- And many more…

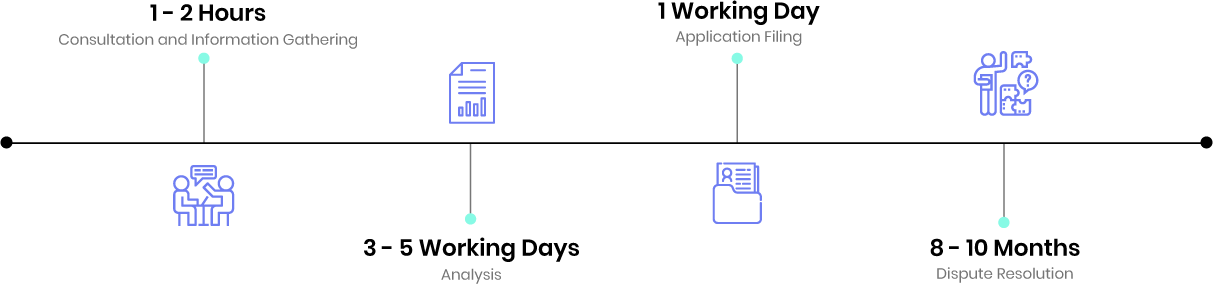

What Is The Process?

1. Gathering Information:

For a thorough understanding of the subject matter and client-side information, our litigation consultants plan extensive discussions with the client and various other stakeholders involved in the matter.

2. Analysis

Our experts then evaluate the current situation on the basis of the client’s and the relevant stakeholder’s information, taking into consideration the relevant companies, securities, contracts, financial and insolvency laws.

3. Solution

Our experts then discuss and have an appropriate legal plan to achieve the desired outcome and court order, based on an in-depth review of the instant case. Each argument is assessed for its strengths and weaknesses accordingly. A final strategy is then laid down.

Details Required

- Details required on a case to case basis.

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What kinds of General Corporate matters does the National Company Law Tribunal deal with?

NCLT addresses civil corporate disputes, covering but not limited to Class Action Suits, Share Transfer Disputes, Oppression and Mismanagement, Reopening of Accounts, Review of Financial Records, Company Deregistration, Voluntary Liquidation and Conversions from Public to Private.

2. Which courts do I approach for cases of Breach of Contract?

Unless a specific form of dispute resolution is prescribed by the contract, all cases must be filed in a competent civil court. This differs on the basis of the dispute’s subject matter, territory, monetary value, etc.

3. I have invested money in a Company that now claims to be insolvent/bankrupt. How can I recover the amount?

In the event of any default by a company, the Insolvency and Bankruptcy Code 2016 empowers creditors to file applications before the NCLT to initiate an Insolvency Resolution Process to pay back its debts.

4. Who can initiate the Insolvency Resolution Process?

The Insolvency Resolution process may be initiated by financial and operational creditors. The company alone could do that as well.

5. I am a financial creditor to a Partnership Firm/ Individual Person, who should I approach in case they fail to pay me back?

The creditor can approach the Debt Recovery Tribunal in such cases.

6. What are the key issues that a party should consider before bringing a claim?

- The nature of the relief.

- Jurisdiction of the court of law.

- The limitation period in relation to the claim.

7. What are the key causes of action in commercial litigation?

The main causes of action that may arise in commercial cases are default in payment and default in complying with other contractual obligations.

8. Can there be amendments to a claim in Commercial Litigation?

Yes, a claim can be modified if the party to the suit can satisfy the court that it is essential in the best interest of the case.

9. How is jurisdiction established in a Commercial Litigation?

Jurisdiction is usually established on the basis of the defendant’s position or where the cause of action has arisen (Territorial Jurisdiction) and on the value of the subject-matter (Pecuniary Jurisdiction).

10. Can a court apply foreign law in matters of commercial litigation?

Indian courts may apply foreign law only if, under a contract, the parties have agreed to be governed by such foreign law. As a matter of fact, the applicable foreign law must be proven by the parties.

11. What are the remedies generally available to the claimant?

- Damages

- Specific Performance

- Debt or Investment Recovery

- An injunction (both permanent and temporary )

- Security enforcement.