Analysis of the New Income Tax Slabs for FY 2025-26

Introduction

The Union Budget 2025 made major changes to the income tax structure under the new tax regime. One critical aspect of the changes is that no taxes will be imposed on income of up to Rs. 12 lakh with enhanced rebates. While the major thrust of these changes is to simplify income tax compliance for citizens and allow the individuals to make the shift to the new tax regime, this article carries an analysis of the new tax slab structure, the compared tax rates, and the benefits accrued out of the improvements.

In India, income tax is imposed according to the tax slab within which such income falls. Slabs are defined for different amounts of income, and each slab is assigned a different rate of tax, which rises intermittently with a rise in income. The slab structure was envisaged to establish a fair system of taxation throughout the country. Generally, changes to the income tax slabs are proposed during the budget speech. Income tax is computed under the three age-based categories.

- Individuals below 60 years of age.

- Senior citizens between 60 years and 80 years of age.

- Super senior citizens above 80 years of age.

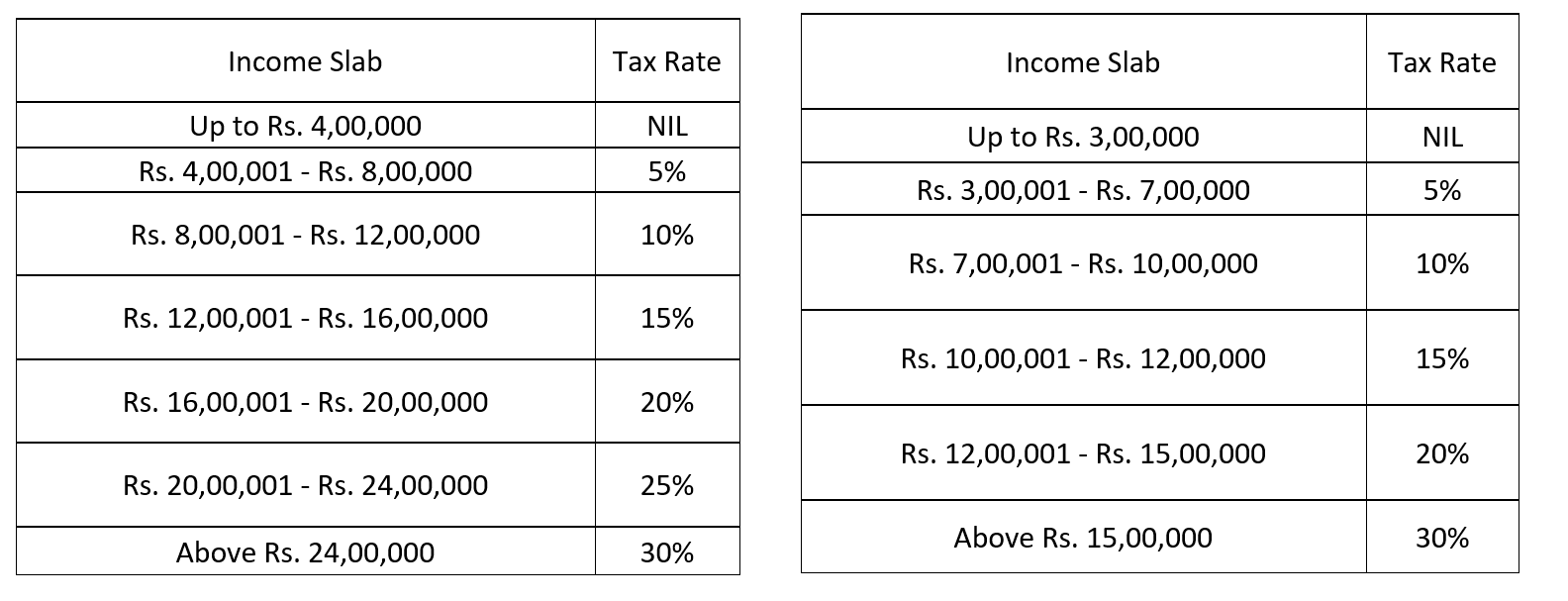

New Tax Regime for FY 2025-26 (AY 2026-27) and the old regime for FY 2024-25 are as follows:

(New Regime) (Old Regime)

Key Differences

Higher Basic Exemption Limit: The exemption limit has been raised from Rs. 3 lakh to Rs. 4 lakh.

Lower Tax Incidence for Middle-Income Groups: The tax rates for income up to Rs. 24 lakh have been modified to provide more relief.

Enhanced Rebate under Section 87A: The rebate has been increased from Rs. 25,000 to Rs. 60,000, leading to NIL tax liability for income up to Rs. 12 lakh.

Exemplary Analysis of Tax Savings and Benefits between the old and new regime:

| Income | Tax (Previous) | Tax (New) | Tax Savings | Rebate Benefit | Total benefit | Tax after rebate benefit |

| Rs. 8 lakh | Rs. 30,000 | Rs. 20,000 | Rs. 10,000 | Rs. 20,000 | Rs. 30,000 | 0 |

| Rs. 9 lakh | Rs. 40,000 | Rs. 30,000 | Rs. 10,000 | Rs. 30,000 | Rs. 40,000 | 0 |

| Rs. 10 lakh | Rs. 50,000 | Rs. 40,000 | Rs. 10,000 | Rs. 40,000 | Rs. 50,000 | 0 |

| Rs. 11 lakh | Rs. 65,000 | Rs. 50,000 | Rs. 15,000 | Rs. 50,000 | Rs. 65,000 | 0 |

| Rs. 12 lakh | Rs. 80,000 | Rs. 60,000 | Rs. 20,000 | Rs. 60,000 | Rs. 80,000 | 0 |

| Rs. 16 lakh | Rs. 1,70,000 | Rs. 1,20,000 | Rs. 50,000 | 0 | Rs. 50,000 | Rs. 1,20,000 |

| Rs. 20 lakh | Rs. 2,90,000 | Rs. 2,00,000 | Rs. 90,000 | 0 | Rs. 90,000 | Rs. 2,00,000 |

| Rs. 24 lakh | Rs. 4,10,000 | Rs. 3,00,000 | Rs. 1,10,000 | 0 | Rs. 1,10,000 | Rs. 3,00,000 |

| Rs. 50 lakh | Rs. 11,90,000 | Rs. 10,80,000 | Rs. 1,10,000 | 0 | Rs. 1,10,000 | Rs. 10,80,000 |

Observations:

- Tax Savings:

- For income up to Rs. 12 lakh, tax savings are relatively modest at Rs. 10,000 to Rs. 20,000.

- For higher income brackets (Rs. 16 lakh and above), tax savings increase significantly. For example, at Rs. 16 lakh, the tax savings is Rs. 50,000 more comparatively to previous regime, and it continues to grow for higher income levels (Rs. 90,000 at Rs. 20 lakh, and Rs. 1,10,000 at Rs. 24 lakh).

- Complete Tax Rebate for Income Up to Rs. 12 Lakh: Due to the increased rebate, individuals earning up to Rs. 12 lakh will have zero tax liability under the new regime.

- Total benefit: By adding tax saving and rebate as a whole (up to income level of 12lacs) then the total benefit from this regime is savings more money of the individuals then the previous regime.

- Marginal Relief for Higher Income Groups: Taxpayers earning more than Rs. 24 lakh still benefit from a structured slab system that marginally reduces their tax liability.

- *Note regarding marginal relief

Marginal Relief under the New Regime Marginal relief ensures that individuals whose income slightly exceeds Rs. 12 lakh do not face disproportionate tax burdens. The relief will continue to apply in specific cases where the total tax liability increases abruptly beyond Rs. 12 lakh.

Advantages of the New Tax Regime

Simplification of Tax Filing: The removal of numerous exemptions and deductions simplifies tax filing for salaried individuals.

Higher Tax Savings for Middle-Class Earners: Individuals earning between Rs. 8 lakh and Rs. 24 lakh will save significantly on tax payments.

More Disposable Income: Lower tax rates ensure taxpayers have more funds available for spending and investment.

Encourages Compliance: The structured and easy-to-understand tax slabs encourage voluntary tax compliance.

Beneficial for Young Professionals: Individuals at the beginning of their careers benefit from reduced tax rates without requiring complex tax planning.

Conclusion

The revised tax slabs for FY 2025-26 offer a host of benefits, especially for slab earners up to Rs. 12 lakh. By increasing the rebates, adjusting the tax slabs, and applying the marginal relief, the calculations aim to lessen the tax burdens and support better tax compliance. Although the new tax structure still carries a heavy tax liability level for the high-income group, structured levy rates effects well-balanced relief across different sections of income holders. The progressive reform in the Indian tax system demonstrates the government’s real interest in making the economy and citizenry progress and distributions of economic value now in society’s hands.

Author: Ojaswa Bansal, in case of any queries please contact/write back to us at support@ipandlegalfilings.com or IP & Legal Filing