17+ Years, More than 20,000 clients and 10,000+

registrations done

Overview

Over the last six decades, the micro, small, and medium enterprise (MSME) sector has emerged as a highly vibrant and competitive sector of the Indian economy. MSMEs not only play a crucial role in providing significant employment opportunities at comparatively lower capital costs than large industries but also in helping to industrialize rural and backward regions, thus eliminating regional imbalances and ensuring that national income and wealth are spread more equitably.

As per the current amended definition of the MSME sectors, the distinction between the manufacturing and services enterprises has been eliminated by making investment amounts and annual turnover identical for enterprises engaged in both sectors. The amended following types of enterprises are recognized as under:

- Micro Enterprises – Enterprises having an investment of less than Onecrore and turnover less than Five crores, for both the manufacturing and service sector.

- Small Enterprises – Enterprises having investment not exceeding Ten crores and turnover not exceeding Fifty crores, for both the manufacturing and service sector.

- Medium Enterprises – Enterprises having investment not exceeding Fifty crores and turnover not exceeding Two Hundred and Fifty crores, for both manufacturing and service sector.

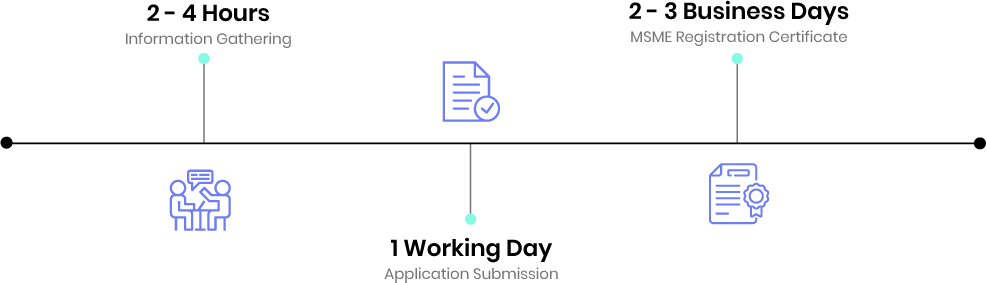

What Is The Process?

Registration is carried out entirely online, along with the submission of an online form and a soft copy of the relevant documents. The application is submitted by the furnishing company and the applicant’s personal details. Any inconsistency in the application that needs to be rectified will be notified. The hard copy of the MSME certificate will not be issued, only the soft copy will be sent via email.

Details Required

- Name of enterprise/business and its main business activity

- Aadhar Number of the Applicant

- Certificate of incorporation of your organization

- MoA and AoA or Partnership deed

- Annual Turnover

- Investment in Plant & Machinery / Equipment

- Type of organization being opted for

- Copy of PAN card

- Address proof of registered office address.

- Valid Mobile number and email address

- Bank Account Number and IFSC code

- NIC code

- Number of employees

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. What is MSME Registration?

Under the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006, MSME Registration is done. The MSME Act seeks to facilitate the promotion, growth, and competitiveness of micro, small, and medium-sized enterprises. Registration offers a range of benefits for micro, small and medium-sized enterprises, as well as access to different subsidies and schemes.

2. Is MSME Registration compulsory?

No, it is not mandatory to get an MSME registered.

3. What is Provisional Registration Certificate (PRC)?

This is given for the pre-operative phase which allows the units to become operational and receive funding and approvals. With a PRC, under priority sector lending, a company can secure loans and working capital from financial institutions/banks as well as obtain different NOCs and permissions/licences, viz. Pollution, labor, etc.

4. What is Permanent Registration Certificate?

The actual MSME certificate is the Permanent Registration Certificate. This enables the registrant to benefit from the different benefits and schemes available to the MSME (including tax exemptions, lower tariffs and credit rates, etc.).

5. What is the validity of MSME Registration?

The PRC expires at the end of five years or until the unit becomes operational or if the investment caps are met by the unit. When the unit is not yet operational or exceeds the cap, one can re-apply. When the unit starts its service, the Permanent License may be applied for. The Permanent License remains valid until the investment cap is reached by the unit.

6. Is the MSME certificate issued online?

Yes, the certificate can be issued electronically by email to the applicant after the application form has been filed on the website.

7. Do we get a physical copy of the MSME Certificate?

No, as the government believes in paperless work and environmental protection, a physical copy of the MSME Certificate is not issued.

8. Who Can Apply for MSME Registration?

For MSME Registration Online, any entrepreneur with a valid Aadhaar number may apply.

9. What are the chances of rejection of Online MSME Application?

The Government will accept any application. No application will be denied. On the basis of the details submitted by the applicant, the application will be approved.

10. What benefits do the Tool Rooms of Ministry of MSME provide to MSMEs?

The Tool Rooms are equipped with state-of-the-art equipment and machines. They are involved in the design and manufacture of quality instruments required for the development of quality goods, as well as improving the competitiveness of MSMEs in the domestic and international markets. They also undertake training programs to provide industries, especially MSMEs, with skilled manpower. The placement of Tool Room-trained trainees is more than 90 percent. Under the DC (MSME), there are 18 Autonomous Bodies (10 MSME Tool Rooms and 8 Technology Development Centers).

11. Is credit score necessary for MSMEs?

No, Credit Score is not a requirement for MSMEs.

12. What are the activities excluded under MSME in India?

Activities which are excluded under MSME are as follows:

- Activities in Forest and Logging;

- Fishing and aquaculture-related activities;

- Retail trade, wholesale, and maintenance activities for motor vehicles and motorcycles;

- Wholesale-related activities, excluding motorcycles and commercial vehicles;

- Retail Trade Practices Except for motorcycles and motor vehicles;

- Household-related activities as staff for domestic personnel;

- Activities related to undistinguishable goods and services-producing activities of private households for own;

- Activities are related to extraterritorial bodies and organizations.

13. What are the benefits of MSME Registration?

The advantages of MSME registration are as follows:

- Registration of MSMEs allows obtaining government tenders With a bank loan, 15% import subsidy on fully automatic machinery.

- Irrespective of the field of business Compensation of ISO certificate expenditure, it becomes easy to get licenses, approvals and registrations.

- Helps to secure low interest rates.

- Tariff subsidies for registered MSMEs and tax and capital subsidies Obtains exemption under Direct Tax Laws.