17+ Years, More than 25000 clients and 500+

registrations done

Overview

Employee Provident Fund Registration

Provident Funds act as a social security tool for individuals of which the Employee Provident Fund (EPF) is one of the major forms. In India, Employees Provident Fund (EPF) is a scheme under the Employees & Provident Funds and Miscellaneous Provisions Act, 1952. The regulation of EPF is done under the purview of Employees’ Provident Fund Organisation (EPFO) which is one of the World’s largest Social Security Organizations in terms of clientele and the volume of financial transactions undertaken.

The registration of EPF is mandatory for any establishment which has more than 20 employees or Co-operative societies with more than 50 employees. Entities are required to register themselves within a month of attaining the minimum strength, with penalties applicable for registration delays. Voluntary registration is possible in case an establishment does not have the minimum prescribed strength. The employer shall be responsible for deduction & payment of PF.

What Is The Process Employee Provident Fund Registration ?

EPF registration process is done by furnishing relevant information and documents about the establishment. In an offline process, the applicant has to fill-up and submit a hard copy of the relevant Form.

Step 1

Basic information about the establishment is filled and submitted.

Step 2

Establishment Login ID is generated after verifying Mobile Number and Email ID.

Step 3

Log in with the Credentials shared to complete the Form.

Step 4

DSC registration is required once the registration of the establishment has been completed.

Step 5

EPF certificate is issued along with the Unique Identification Number.

Step 6

Download the Letter/Certificate issued, along with other required documents to the concerned EPF Office.

Details Required

- Name and Address of Company

- details of Head Office and Branch Office(s)

- Certificate of Incorporation of the Entity

- Permanent Account Number (PAN)

- Identity and Address proof of Director/ Partner

- DSC

- Address Proof of the premises

- Bank details (optional)

- Monthly strength of the number of employees

- Details and Register of Salary and Wages

- Balance Sheet of the Employer

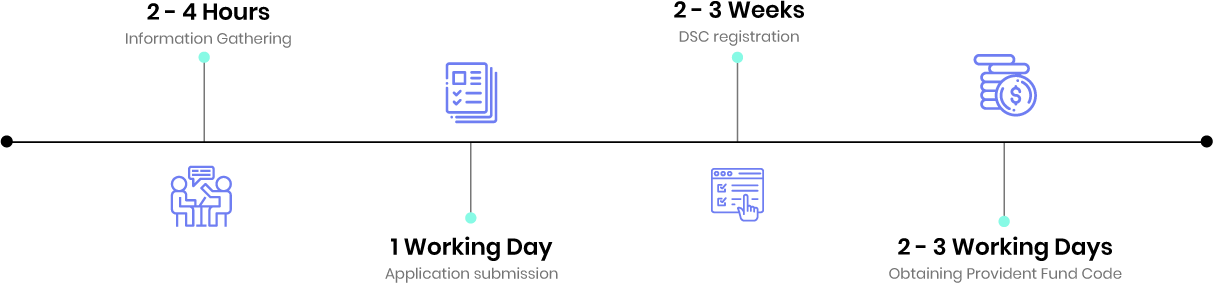

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. Who must register for Provident Fund (PF)?

PF registration is mandatory for an establishment with more than 20 employees or Co- operative Societies with more than 50 employees. It is likely very soon that the threshold limit will be dropped from 20 to 10 employees.

2. While calculating the limit of 20 employees, will every employee and labour force be counted?

The limit of 20 includes all permanent, semi-permanent and other contract employees like housekeeping, security or other contractual workers in the business.

3. Is PF registration compulsory for all employees?

Yes, registering with EPFO and regularly contributing to the EPF is mandatory for applicable organizations.

4. What is the basic salary limit for PF?

An employee earning more than Rs. 15,000 per month in basic salary plus dearness allowance is the basic limit. Basic salary generally includes all payment and perquisites which are not added or taken-off based on certain employment criteria (viz. bonus, overtime, deductions for office cab or another facility, etc.).

5. Who can open the EPF account?

A provident fund account is to be opened only by an employer on behalf of an Indian employee. No individual can open a Provident Fund account in his or her individual name.

6. What is the contribution rate to the Provident fund & pension scheme?

Registered employers need to deposit 12% of the basic salary of each eligible employee in the provident fund account. Eligible employee needs to contribute in total 12% of his/her basic salary, with 3.67% being to the provident fund and 8.33% in the pension scheme.

7. Is employee provident fund is taxable?

Provident fund contribution by the employee is not taxable for Income Tax purpose.

8. How to Cancel PF registration?

Registration under EPF cannot be cancelled until and unless the entity wounds up and closes down. PF Commissioner may consider special cases where an employer undertakes that there is no employee left and in future, no employee will be hired. After the presentation of all documents to the satisfaction of the commissioner, cancellation may be granted.

9. Will PF registration help in the collection of pensions?

Yes, PF registration will help in the collection of pensions as PF registration has a direct impact on the pension scheme. Out of the total EPF contribution made by the employer towards the Provident fund, 8.33% goes into the Employee Pension Scheme, which is used for collecting pensions after the retirement of the employee.

10. Can you withdraw EPF money if you switch your job?

It is illegal to withdraw money at the time of switching the jobs as it can be transferred once you join a new job. However, you can withdraw your EPF money if you have not joined any other job for a period of two months from quitting the earlier job.