13+ Years, More than 25000 clients and 10000+

registrations done

Overview

Goods and Service Tax (GST)

GST Registration: Goods and Services Tax (GST) is meant to replace a number of central and state indirect taxes with a unified tax, and is therefore expected to streamline and ease in doing business. In India, any person, firm, or organization undertaking a supply of taxable goods is mandatorily required to register under GST if, they have crossed the annual aggregate threshold limit of Rs. 40 Lakh (20 Lakh for North East states and the Hilly States.) or they are having inter-state transactions.

There are certain other conditions and exemptions for the applicability of threshold limit: for instance an e-commerce aggregator or a person who supplies through an e-commerce aggregator has to mandatorily register for GST. GST registration requires obtaining a GST Number, GSTIN, from the tax authorities. GSTIN is a unique 15-digit number, usually linked to the PAN and is used to monitor tax payments and compliance.

As a goods or service provider, if you fail to register for GST, you can incur heavy fines and penalties that can go up to 100% of your owed tax amount. Registering for GST means you can also collect GST from your customers. Thus, in order to avoid any conflict with the law, it is essential that you register for GST.

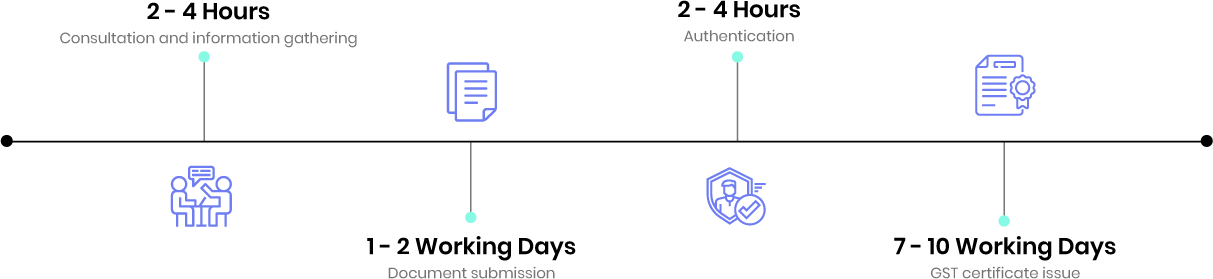

What Is The Process?

1. Consultation

Our representative gets in touch with you to understand the nature of your business to guide you through the applicable registration process.

2. Documents submission

There is a requirement to mandatorily submit the GST Application form and other information and documents required.

3. Authentication

All the submitted details are required to be authenticated via email and OTP verification.

4. Issuance of GST certificate

Acknowledgement Number with GST No. is issued in due course of time, followed by the issuance of the GST Certificate within 7-10 days of the date of application.

Details Required

- PAN Card of company/ firm/ proprietor

- PAN Card of all directors/ partners of the company/ firm

- Address and identity proof of all directors/ partners

- Bank account details

- Photographs and Authorized Signatory of proprietary

- Copy of incorporation document in case of a legal entity

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Proof of appointment of Authorized Signatory

- PAN Card, address, and identify proof of Authorized Signatory

Timeline

Testimonials

Get Started

Frequently Asked Questions

1. When is GST Registration required?

Businesses having turnover exceeding Rs. 40 Lakhs (Rs 20 lakhs for NE and hill states) are required to have GST registration.

2. What is the turn over limit for GST Registration?

Currently, businesses with a turnover of up to Rs 40 lakh are exempt from GST registration, while the limit for hilly and northeastern states is Rs 20 lakh.

3. Who are exempted from GST Registration?

Section 23 (1) states that persons who are engaged in supplying goods or services or both that are not liable to be tax or persons who are engaged in supplying of goods or services or both that are wholly exempted from tax, then, such persons are not required to obtain GST registration.

4. What is GSTIN?

All businesses that successfully register under GST are assigned a unique Goods and Services Tax Identification Number also known as GSTIN.

5. When should a business apply for multiple GST registrations?

If a business operates from more than one state, then a separate GST registration is required for each state. For instance, if a sweet vendor sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and TN respectively. A business with multiple business verticals in a state may obtain a separate registration for each business vertical.

6. Who needs to register for GST in India?

As per GST rules, businesses which has a turnover of above Rs.40 lakh needs to mandatorily register for GST. For the north-eastern states, Jammu and Kashmir, Uttarakhand and Himachal Pradesh, the turnover is Rs.10 lakh. In addition to that, the following also needs to register for GST in the country:

- Person supplying online information and database access or retrieval services from a place outside India to a person who is not a registered taxable person.

- Every e-commerce aggregator

- A person who supplies via an e-commerce aggregator

- Individuals registered under the pre-GST law

- Those paying tax under the reverse charge mechanism

- Agents of a supplier

- Input service distributor

- A non-resident taxable person or a casual taxable person

7. Can I surrender my GST number?

Yes, you can surrender the GST number. However, you can do so only after one year from the date of registration. It can be carried out in the following three ways:

- The registered person can apply for cancellation.

- Canceled by the GST Officer.

- The legal heir can apply for cancellation following the death of the proprietor.

8. Is there a provision for a person to get himself voluntarily registered though he may not be liable to pay GST?

Yes. In terms of sub-section (3) of section 25, a person, though not liable to be registered under sections 22 or 24 may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered taxable person, shall apply to such person.

9. Whether the Registration granted to any person is permanent?

Yes, the Registration Certificate once granted is permanent unless surrendered, cancelled, suspended, or revoked.

10. Who is a Non-resident Taxable Person?

As per sub-section 77 of section 2 of CSGT Act, 2017 “non-resident taxable person” means any person who occasionally undertakes transactions involving the supply of goods or services or both, whether as principal or in any capacity, but has no fixed place of business or is not an Indian resident.